Browse Properties

Download Now

Schedule a Consultation

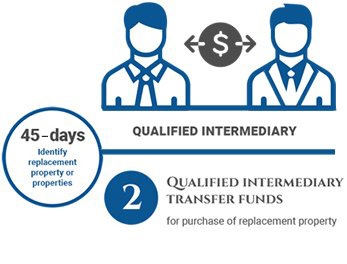

Process of a Typical

1031 Exchange

THERE ARE 3 BASIC STEPS IN A TYPICAL 1031 EXCHANGE

45 DAY IDENTIFICATION PERIOD

The taxpayer must identify potential replacement property or properties within 45 days from the date of sale.

180 DAY EXCHANGE PERIOD

The taxpayer must acquire the replacement property or properties within 180 days.

*Closing on the replacement property must be the earlier of either 180 calendar days, after closing on the sale of the relinquished property of the due date, for filing the tax return for the year in which the relinquished property was sold; unless an automatic filing-extension has been obtained

Watch Our Informative Videos

Full Cycle DSTs

Relationships begin with communication. Let’s start a conversation.

Don’t Foul Up Your 1031 Exchange! Download Our Simple to Follow Checklist As Your Guide!

Swap one asset for another

Limit the amount of tax due

Capital gains avoided until final asset sold

Special eligibility rules

Management required to avoid depreciation recapture

Not all situations are the same

The Fortitude Difference

With over 100+ years of combined experience facilitating 1031 Exchanges, including the largest 1031 Exchange utilizing DST’s in our industry, we are your trusted partners in helping you seek success. We believe that education and service matter, and we are committed to providing our clients with the resources required to facilitate the entire exchange process.

Experience in Section 1031 Exchange securitized real estate

Careful due diligence

Full disclosure of all details and parties

The security of bonded, reputable, qualified intermediaries

We Will Help You Find Replacement Property and Correctly Navigate Your Exchange

1. Create an Account

2. Browse Properties